- #SIMPLE INVOICING NUMBER CONVENTION SERIAL#

- #SIMPLE INVOICING NUMBER CONVENTION SOFTWARE#

- #SIMPLE INVOICING NUMBER CONVENTION SERIES#

Save taxes with Clear by investing in tax saving mutual funds (ELSS) online. Clear can also help you in getting your business registered for Goods & Services Tax Law. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax.

#SIMPLE INVOICING NUMBER CONVENTION SOFTWARE#

Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.ĬAs, experts and businesses can get GST ready with Clear GST software & certification course. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Just upload your form 16, claim your deductions and get your acknowledgment number online. Clear serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India.Įfiling Income Tax Returns(ITR) is made easy with Clear platform. The invoice number will automatically be updated to the following sequential number whenever you create a new quote or invoice.Ĭlear offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India.

#SIMPLE INVOICING NUMBER CONVENTION SERIES#

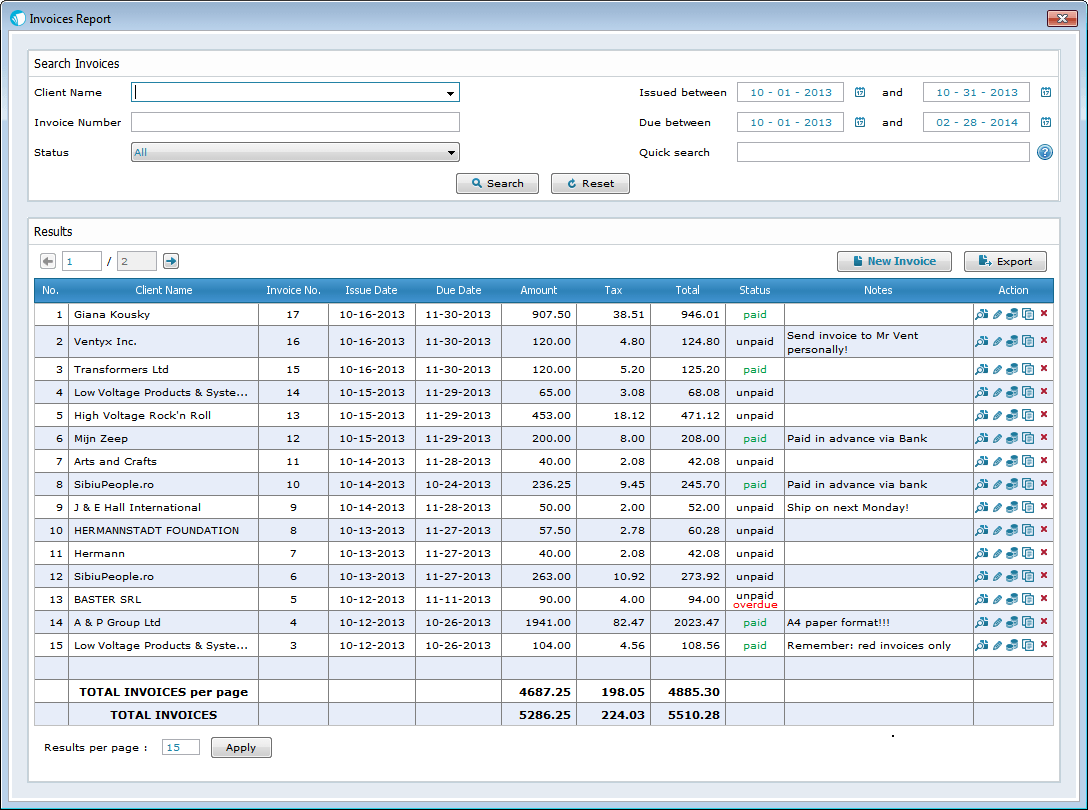

Invoice Numbers with ClearOneĬlearOne comes with multiple invoice templates to choose your own custom invoice number series according to your business requirements. Also, a business can use the name of a business unit or project as a reference for invoice numbers. This yearly system allows you to quickly see which year an invoice is issued and follows the sequential numbering requirement.

#SIMPLE INVOICING NUMBER CONVENTION SERIAL#

Also, one can mention the invoice number mentioning the month and year, such as INV/2020-21/01/09, where 2020-21 is the year, 01 is the month, and 09 is the serial number. At the start of a new year, one should reset the invoice numbers, i.e., the first invoice number of 2021 would be ‘210001’. The subsequent invoices would be ‘200002’, ‘200003’, and so on. For example, within a sequence that refers to the year, the first invoice in 2020 could be ‘200001’.

Still, it is essential to consider future growth while choosing an effective invoice numbering system.Īn effective way to create a longer, more specific invoice number includes the month or year when the invoice was issued. Newly started businesses may not have large numbers of invoices in the beginning. This activity can be confusing when invoice numbers reach double or triple figures. It is not good to assign simple invoice numbers such as ‘1’, ‘2’, ‘3’, etc. An invoice number sequence should never consist of repeats or gaps. Invoice numbers should be assigned sequentially, which means the number of each new invoice should increase. This is a common mistake that new businesses or freelancers may make. It is to be noted that the invoice number is serially numbered for business as a whole and not client wise. Otherwise, clients will reject invoices, as it makes it cumbersome for them to track payments if the vendor loses the tracking, he has to spend time reissuing the invoice. So, the invoice without an invoice number will be considered an illegal document and subject to penalty.Īlso, the invoice number is a mandatory field in the following processes:Īlso, the invoice numbers are helpful as a reference for all the payments and receipts of a business. As per this rule, the tax invoice issued must contain consecutive tax invoice number (up to 16 characters), and each tax invoice will have a unique number for that financial year. Rule 46 of the CGST Rules deals with the contents of the invoice applicable for GST registered persons. Hence, it is important to assign invoice numbers for each invoice for easy tracking. It is vital to keep track of invoices issued and received for accounting sales and purchases in the books of accounts.

Invoices are the most essential documents for any business.

0 kommentar(er)

0 kommentar(er)